Introduction: The Tempting Power of Generative AI

The banking sector stands at the edge of a technological revolution. With artificial intelligence (AI) — especially generative AI — making headlines for automating workflows, boosting personalization, and improving fraud detection, banks are under pressure to adopt or fall behind.

But here’s the question that needs clarity: Is generative AI safe for the banking sector?

This question matters more than ever. It’s not just about staying ahead of competitors — it’s about earning and keeping customer trust, maintaining compliance, and avoiding costly mistakes in highly regulated financial environments.

In this blog, we’ll explore the practical realities of generative AI in banking — the risks, rewards, and the roadmap for responsible implementation.

The Growing Use of Generative AI in Banking

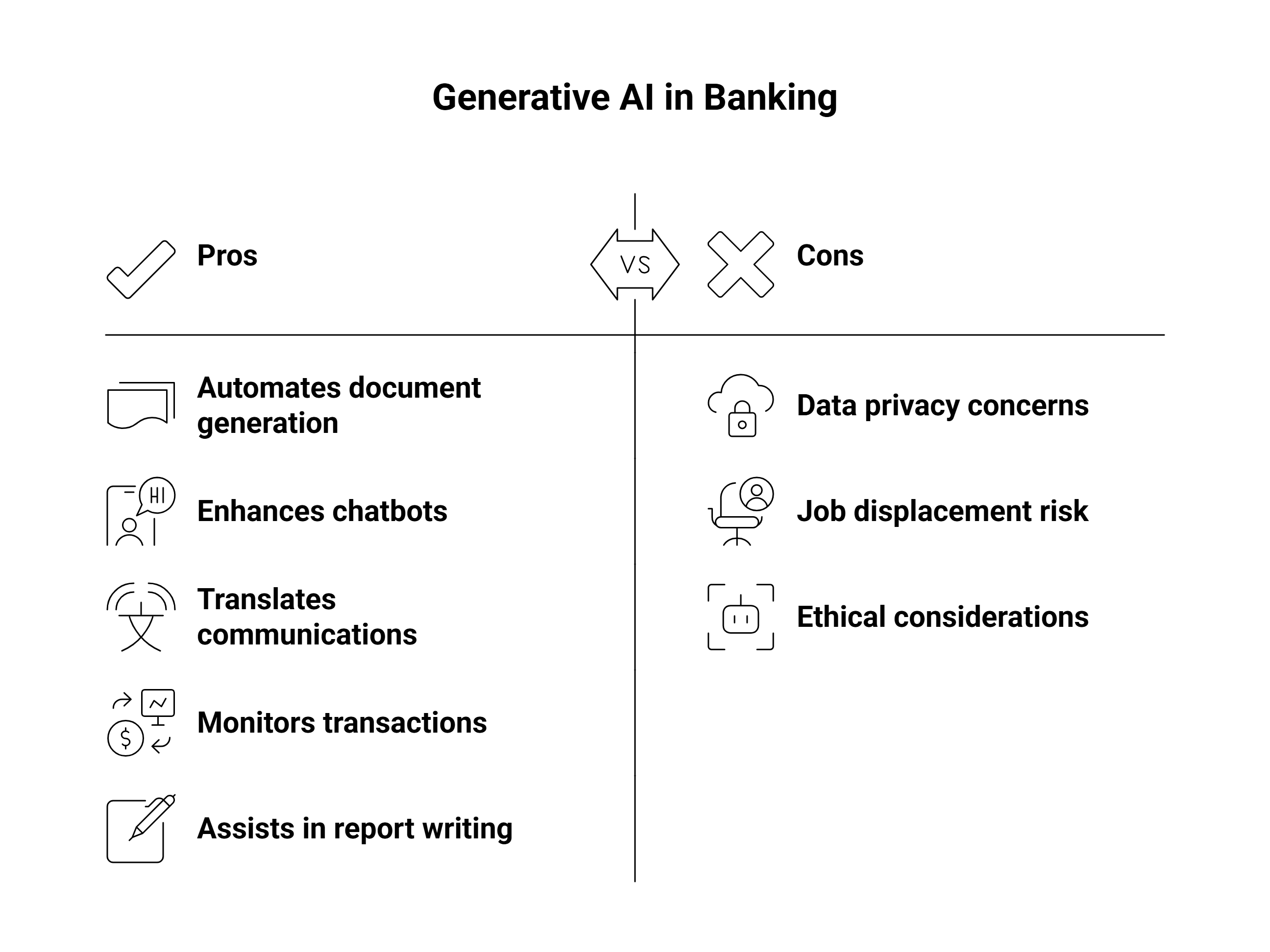

Generative AI refers to models that can create human-like text, summaries, code, audio, and even images. In banking, these tools are increasingly being used to:

- Automate document generation for loans, KYC, and compliance

- Enhance chatbots and virtual assistants with real-time summaries and personalized messaging

- Translate communications for global customers

- Monitor transactions and generate fraud alerts

- Assist in report writing, marketing content, and internal communication

Example:

A leading Asian bank implemented a generative AI assistant to summarize customer service calls, reducing after-call work by 40% while improving NPS by 12%.

The potential is real, but it’s not without concerns.

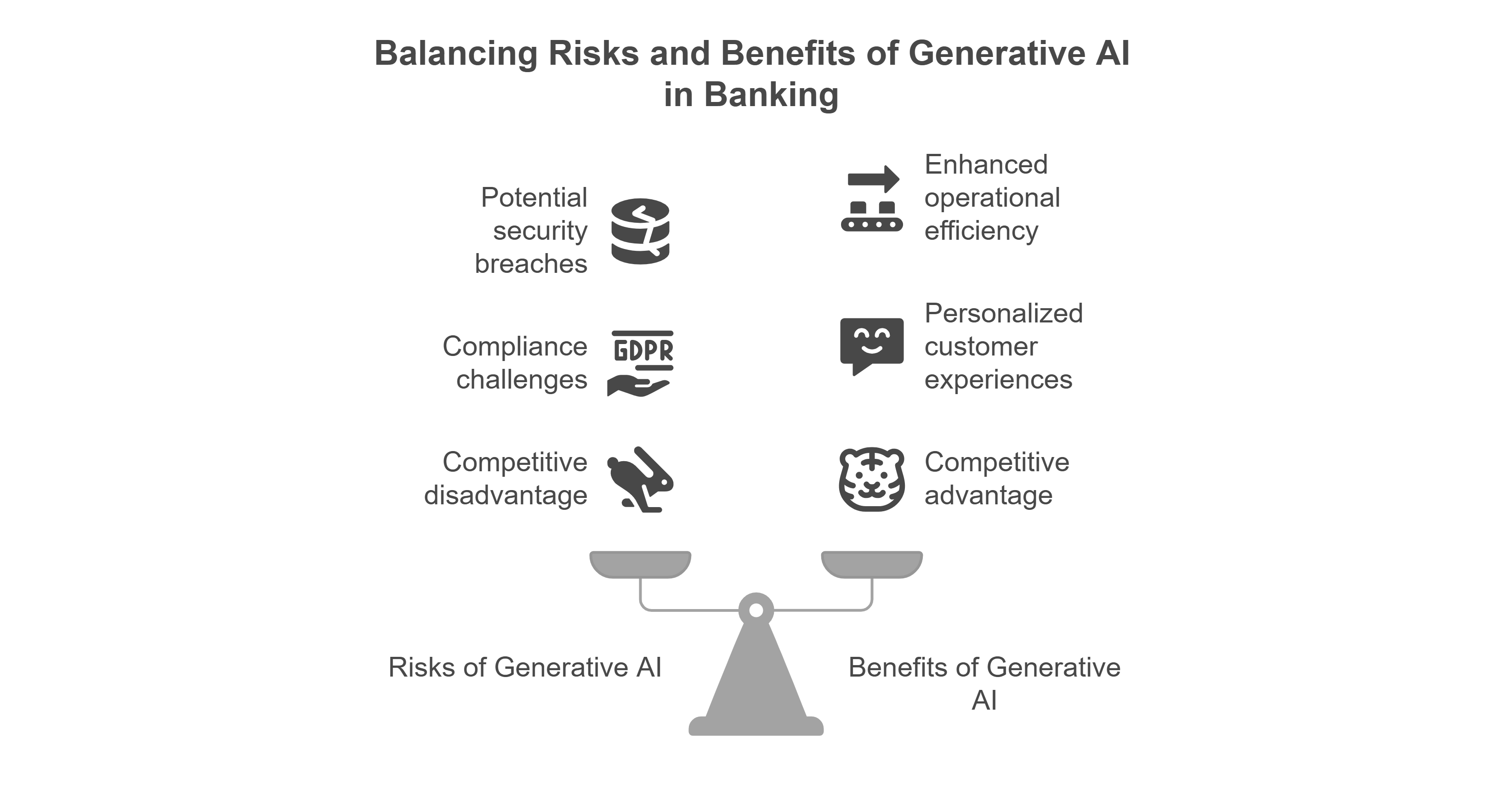

Risks of Generative AI in the Financial Sector

1. Data Privacy & Security

AI models thrive on data. But in banking, data includes sensitive information like financial histories, identification numbers, and credit profiles.

Risk: Inappropriate data handling can lead to breaches, reputational loss, and regulatory penalties. AI models might memorize and regurgitate sensitive data if not properly configured.

2. Compliance and Regulatory Risk

The banking industry is governed by strict data and operational regulations such as GDPR, RBI, Basel III, and country-specific banking laws.

Risk: If generative AI decisions cannot be explained or traced, banks risk violating audit and accountability requirements.

3. Bias in Decision-Making

Generative AI models learn from existing data. If historical data is biased — for example, loan denials skewed by ZIP code or demographics — AI may reproduce and amplify these patterns.

Risk: Discriminatory outcomes that violate fair lending practices and damage reputation.

4. Model Hallucinations and Inaccurate Output

Gen AI models may create plausible-sounding but incorrect or misleading information.

Risk: Miscommunication in critical banking operations like risk profiling or investment suggestions.

5. Lack of Explainability

In high-stakes decisions, banks must be able to justify and trace how decisions are made.

Risk: Black-box outputs reduce trust with regulators and customers.

Rewards: Why Banks Are Still Leaning In

Despite the risks, banks are making calculated moves to adopt generative AI — and for good reason.

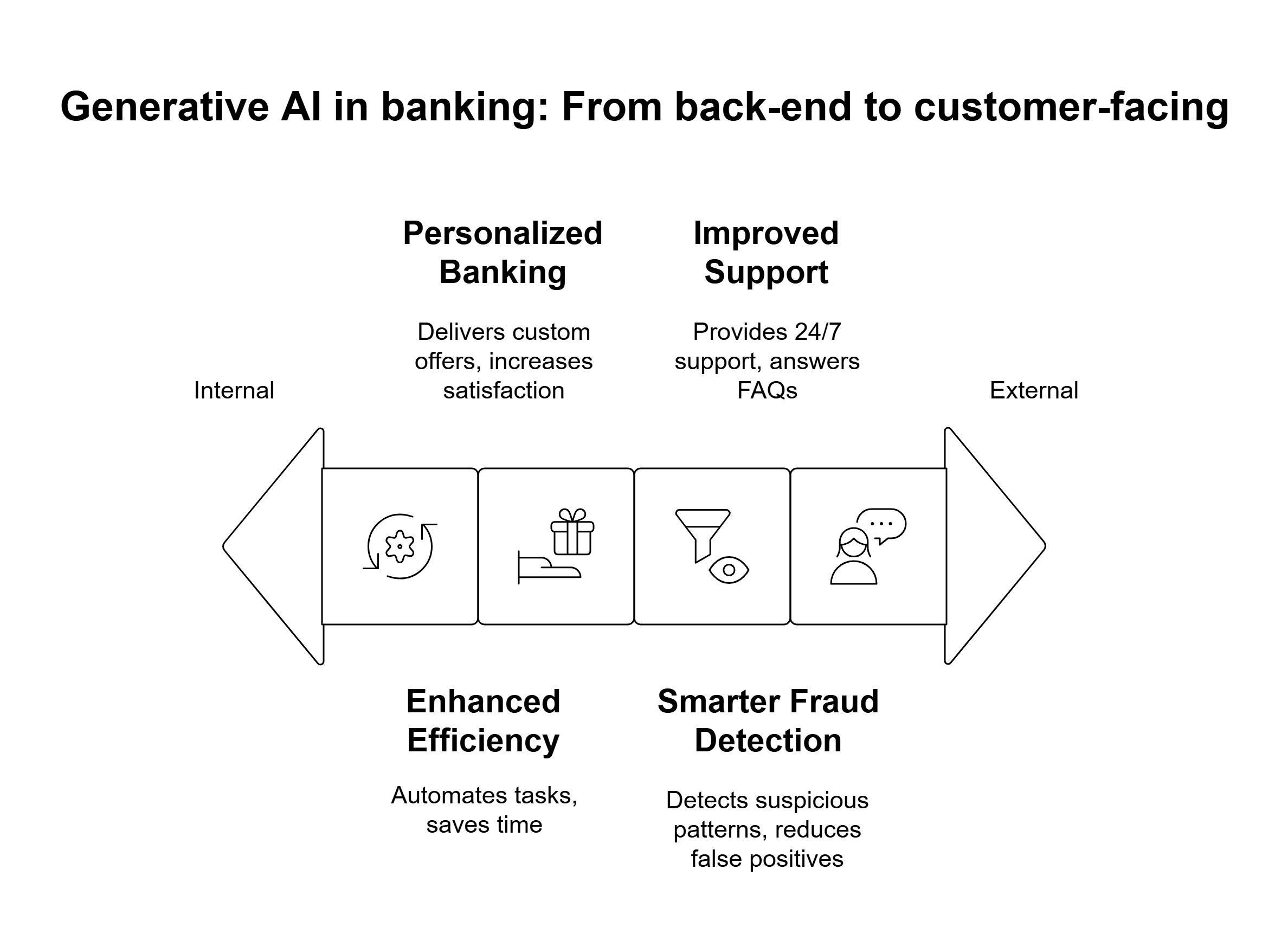

1. Enhanced Operational Efficiency

AI can take over repetitive tasks such as summarizing customer conversations, generating compliance reports, or filling internal documents.

Result: Time savings of up to 30% in operations and support departments.

2. Personalized Banking at Scale

Gen AI analyzes large volumes of customer data to deliver custom recommendations and offers, leading to higher conversion and satisfaction.

Example: Personalized mortgage offers based on customer profile, transaction behavior, and goals.

3. Smarter Fraud Detection

Advanced AI models can detect suspicious behavior patterns that traditional systems might miss.

Result: Reduction in false positives and improved fraud resolution time.

4. Improved Customer Support

Generative AI can drive AI-powered assistants that answer FAQs, guide customers through applications, and even detect sentiment for escalation.

Benefit: 24/7 support with contextual accuracy.

Responsible AI Adoption in Banking: A Proven Framework

To navigate this landscape, banks must pair innovation with caution. Here’s how:

1. Choose Expert Implementation Partners

Working with expert solution providers like Data Sleek ensures compliance from the start. Data Sleek has deep experience with secure AI/ML pipelines, AWS infrastructure, and finance-focused implementations.

How Data Sleek Helps: End-to-end AI deployment with data protection, model explainability, and governance built in.

2. Build with Explainability in Mind

Use explainable AI models and tools that allow teams to audit decisions. Employ XAI frameworks or visualization tools to interpret AI output.

3. Establish AI Governance Policies

- Define ethical AI guidelines

- Create a cross-functional AI oversight team

- Conduct regular model reviews

4. Strengthen Infrastructure and Data Security

Encrypt data at rest and in transit. Set permissions for data access. Monitor for anomalies.

Pro Tip: Move to a secure, compliant cloud platform like AWS with expert support from Data Sleek.

5. Educate and Train Teams

AI adoption must be cultural. Provide ongoing training for employees and leadership to understand AI’s scope, limits, and governance.

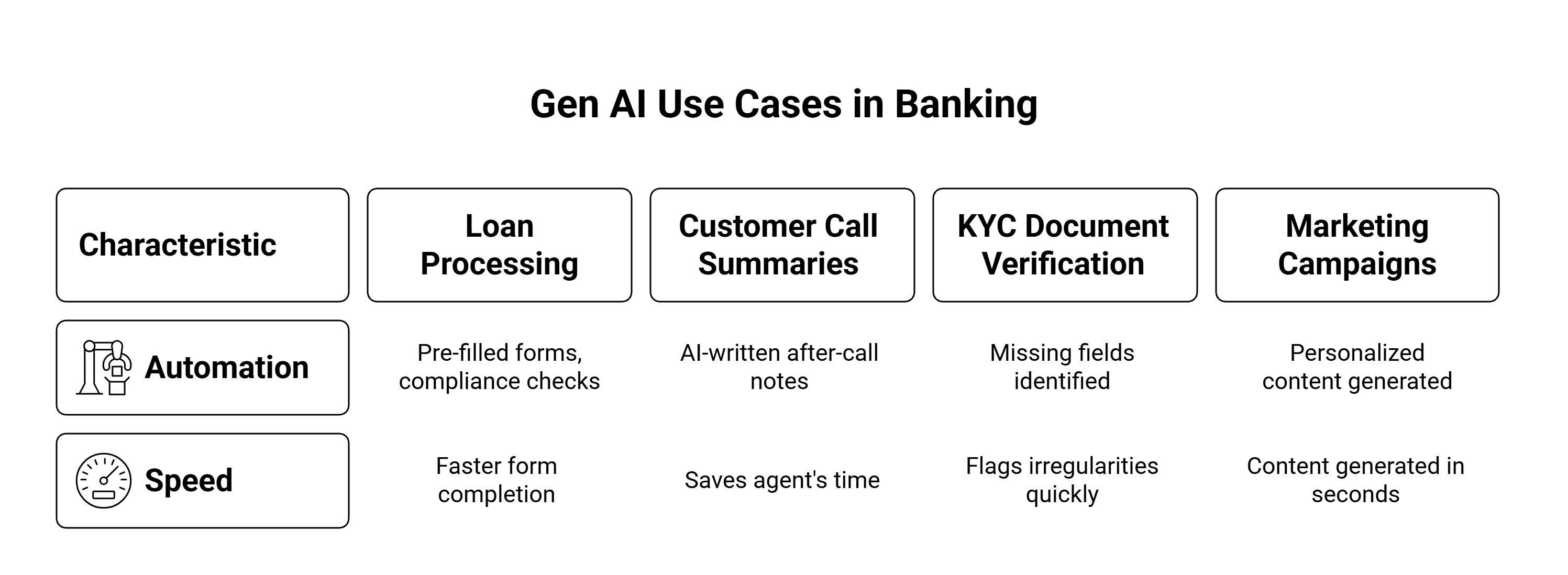

Real-World Use Cases of Gen AI in Banking

- Loan Processing: Gen AI generates pre-filled forms from customer data and automatically checks compliance.

- Customer Call Summaries: Agents save time with AI-written after-call notes in Amazon Connect.

- KYC Document Verification: Gen AI identifies missing fields and flags irregularities.

- Marketing Campaigns: Personalized content is generated for specific demographics in seconds.

Data Sleek enables all of the above by providing integration-ready frameworks tailored to the banking domain.

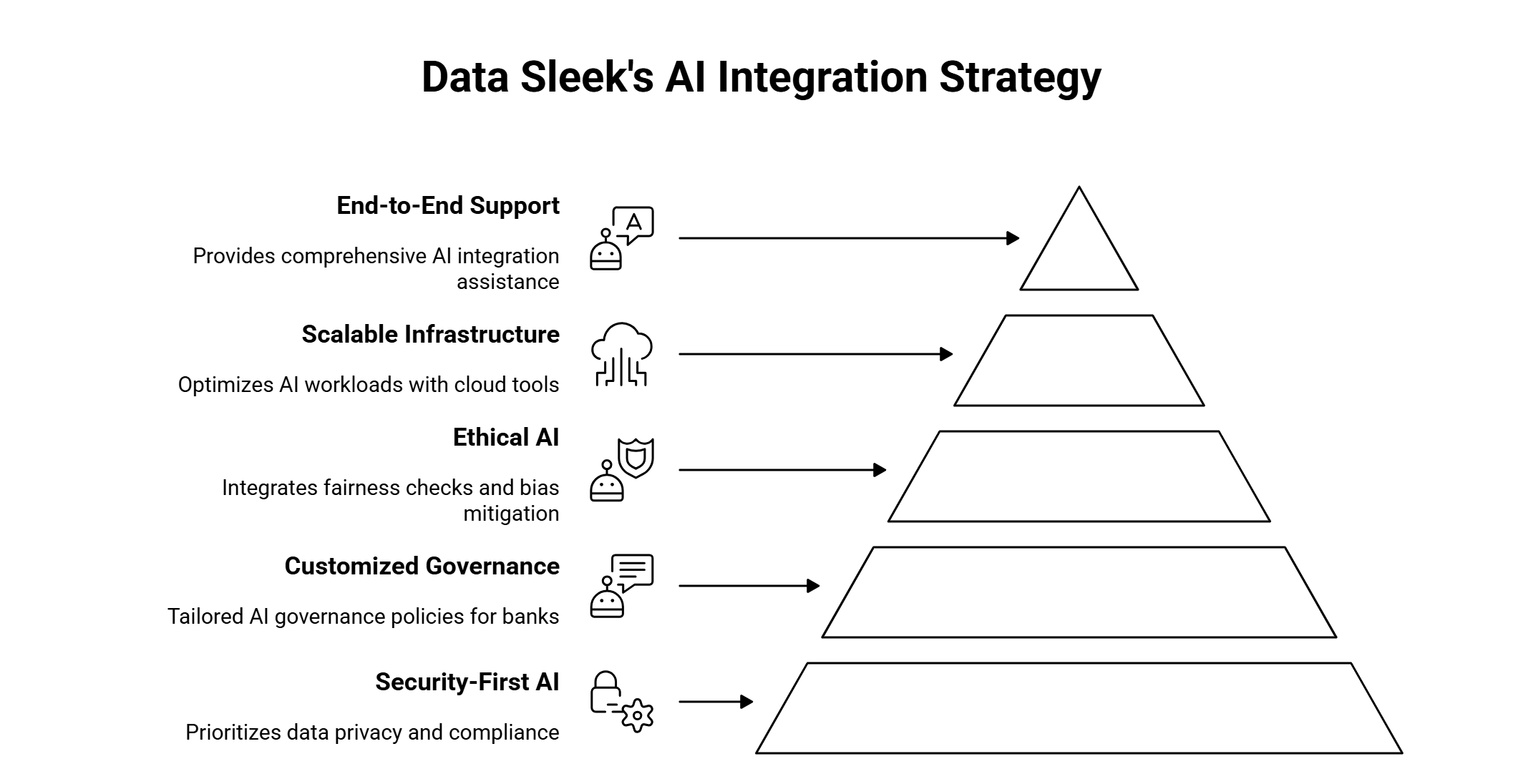

Why Choose Data Sleek for Responsible AI Adoption in Banking?

Implementing generative AI in banking isn’t just about having the right tools — it’s about having the right partner. That’s where Data Sleek comes in.

At Data Sleek, we specialize in helping banks and financial institutions adopt AI responsibly, securely, and strategically. Here’s how we ensure success:

-

Security-First AI Integration

We prioritize data privacy, encryption, and regulatory compliance (GDPR, SOC 2, HIPAA, etc.) in every AI deployment — ensuring that your sensitive customer data is always protected.

-

Customized Governance Frameworks

We help banks design and implement AI governance policies tailored to your organization — covering model training, explainability, data lineage, and human-in-the-loop oversight.

-

Ethical AI Implementations

Our team integrates fairness checks and bias-mitigation mechanisms into every generative AI model — reducing reputational and regulatory risks from the start.

-

Scalable Cloud Infrastructure

We optimize your AI workloads with cloud-native tools like Amazon Connect, AWS SageMaker, and Snowflake, giving you a high-performing, cost-efficient environment that scales as you grow.

-

End-to-End Support

From AI readiness assessments to post-launch monitoring, Data Sleek is with you every step of the way — helping you move fast without breaking things.

Final Thoughts: Safe, Scalable, and Strategic AI Is Possible

So, is generative AI safe for banking? The answer: Yes, if implemented responsibly.

It’s not about ignoring risks — it’s about anticipating them and acting smart. With a clear strategy, the right partners like Data Sleek, and a commitment to transparency, banks can embrace generative AI to:

- Improve operational efficiency

- Deliver personalized customer experiences

- Strengthen security and compliance

- Stay ahead of fintech competitors

If you’re considering AI adoption in your banking operations, don’t go it alone. Work with Data Sleek to ensure:

- Secure and scalable implementation

- Domain-specific compliance and governance

- Integration with AWS, Snowflake, and more

Visit datasleek.com to schedule a free consultation and discover how to make generative AI work — safely and effectively — for your banking organization.