Banking Needs More Than Automation — It Needs Intelligence

The global banking sector faces a paradox.

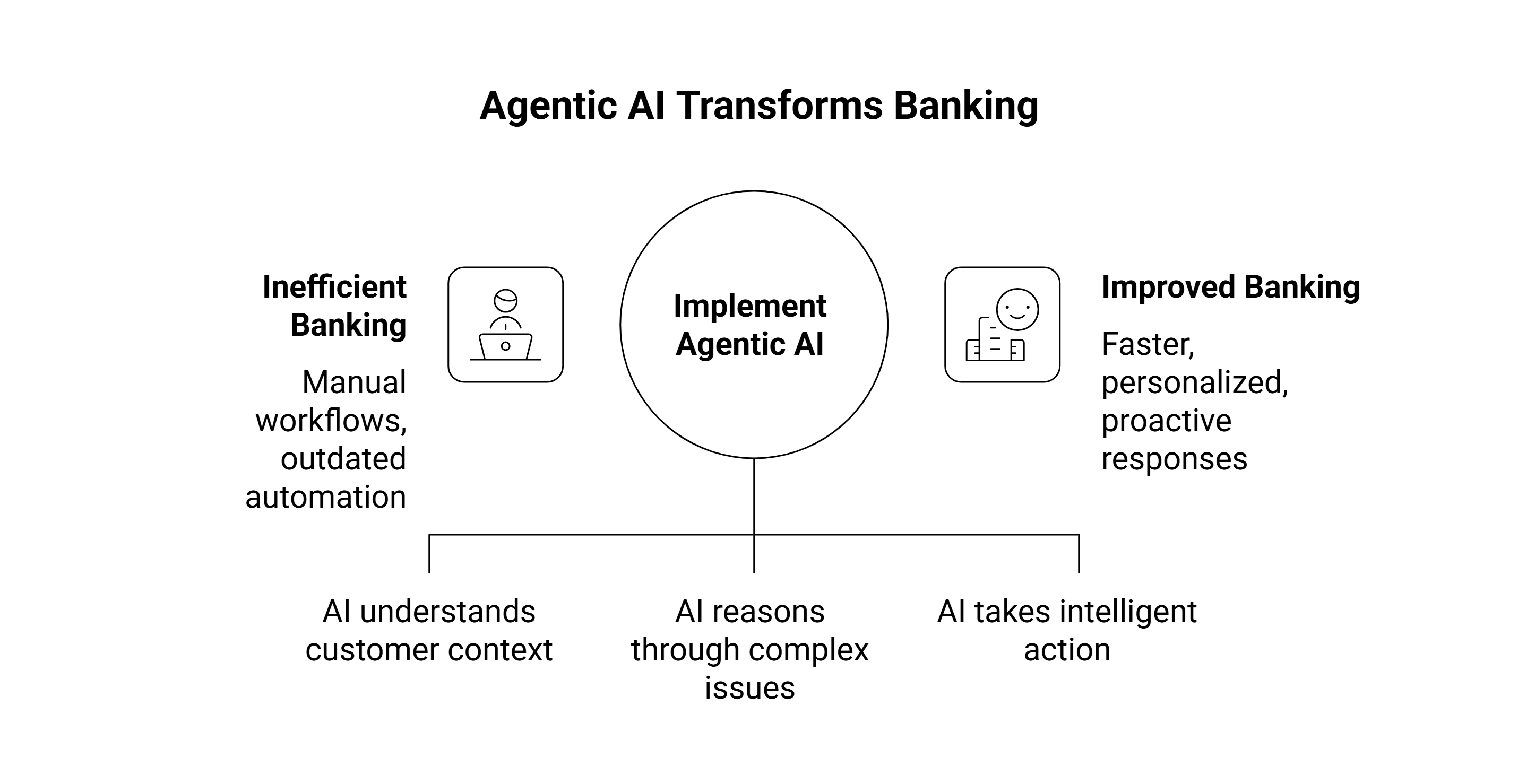

Customers expect instant, personalized responses, yet most contact centers still rely on manual workflows, disconnected systems, and outdated automation tools that can’t keep up with real-time complexity.

Here’s where Agentic AI steps in — a new generation of AI in banking that doesn’t just process commands but understands context, reasons through challenges, and takes intelligent action autonomously.

For banking contact centers, that means fewer compliance errors, faster KYC verification, proactive fraud prevention, and a dramatically improved customer experience (CX).

What Is Agentic AI — and Why It Matters in Banking

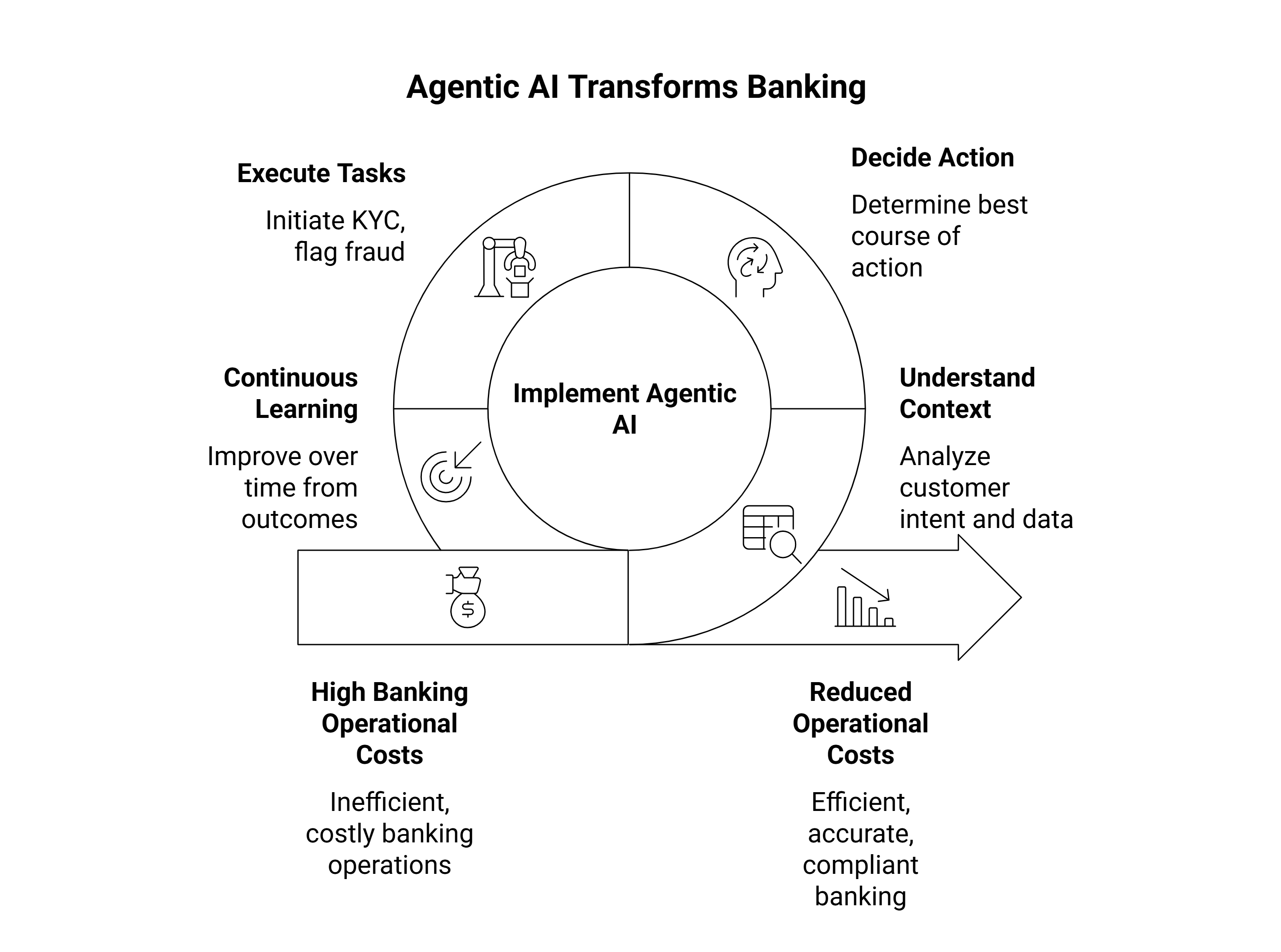

Unlike traditional AI, which reacts only when prompted, Agentic AI is goal-oriented and adaptive.

It combines reasoning, autonomy, and continuous learning to perform complex multi-step tasks — the kind financial institutions face daily.

In simple terms, Agentic AI:

-

Understands context (customer intent, tone, and transaction data)

-

Decides the best course of action based on policies and patterns

-

Executes tasks (e.g., initiate KYC checks, flag fraud, send alerts)

-

Learns from outcomes to improve over time

Think of it as an “AI analyst” embedded in your contact center — one that acts in real time.

According to McKinsey, AI-driven automation can reduce banking operational costs by up to 22% while improving accuracy and regulatory compliance.

The Reality Check: Why Banking Contact Centers Need Agentic AI

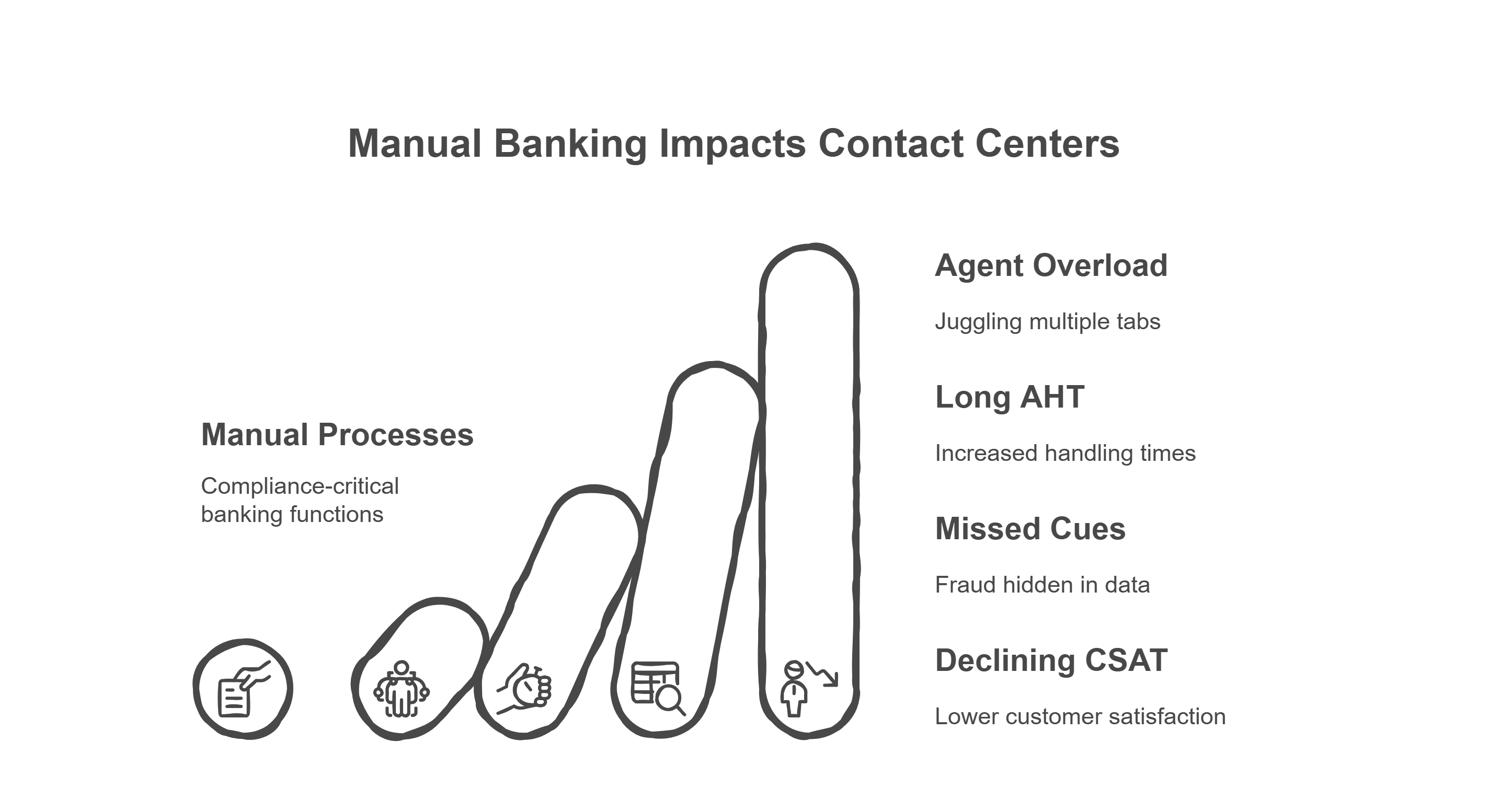

Modern contact centers handle:

-

Thousands of KYC verifications daily

-

Continuous monitoring for AML (Anti-Money Laundering) violations

-

A surge in fraud detection alerts

-

Multiple disconnected systems — CRM, core banking, and compliance tools

The result?

-

Agents juggling 10+ tabs per case

-

Long average handling times (AHT)

-

Missed fraud cues hidden in data noise

-

Declining customer satisfaction (CSAT)

A 2024 Finextra report found that 63% of banking contact centers still rely on manual processes for at least one compliance-critical function.

This isn’t sustainable — especially when contact center automation and real-time decisioning now define customer trust.

How Agentic AI Reinvents KYC (Know Your Customer)

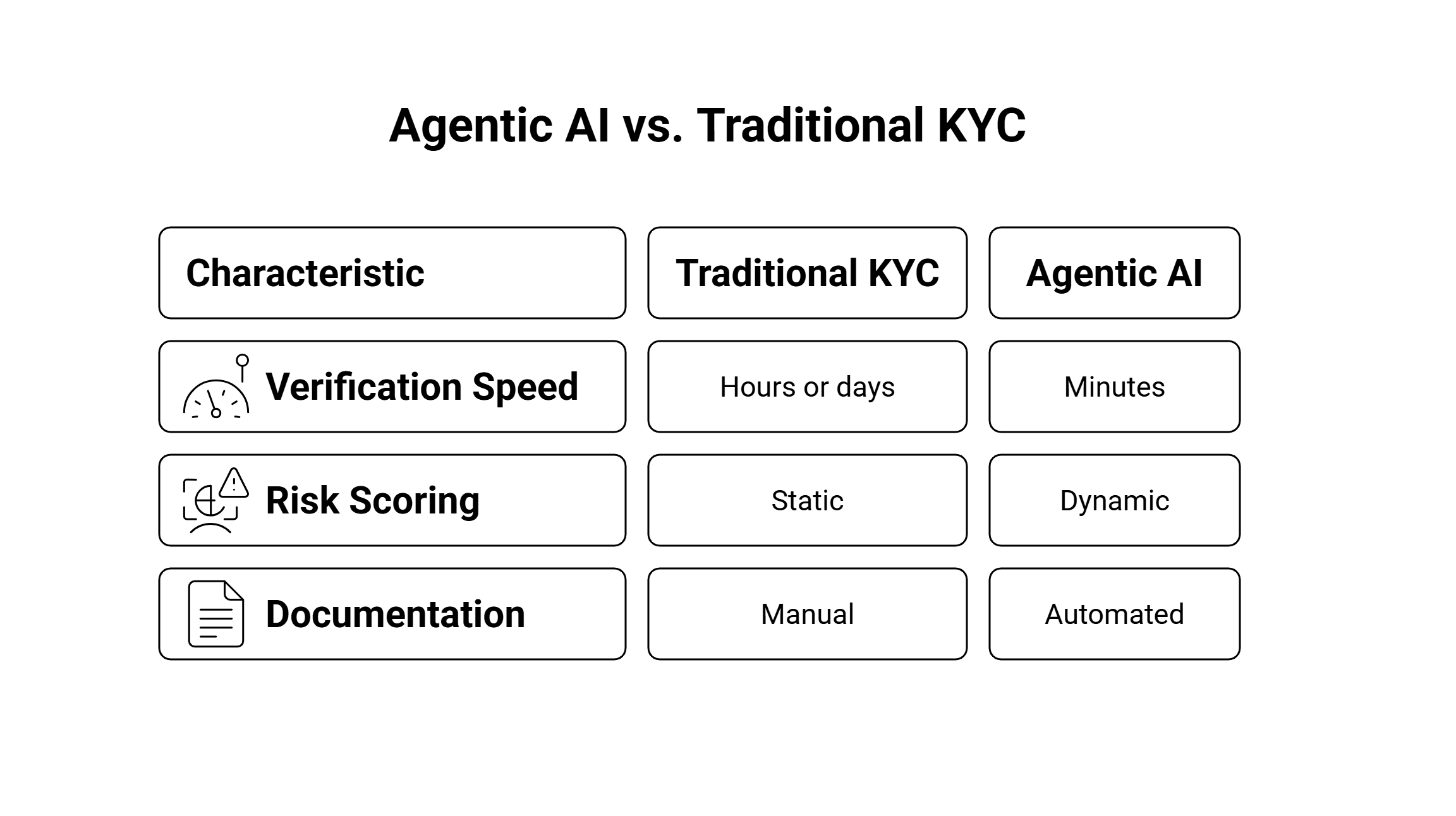

1. From Manual Checks to Autonomous Verification

Traditional KYC involves document uploads, human reviews, and backend updates — a process that can take hours or days.

With KYC automation powered by Agentic AI, the entire flow compresses into minutes:

-

Customers submit IDs, utility bills, or proof-of-address documents.

-

AI uses computer vision to validate authenticity (holograms, tampering, etc.).

-

It cross-references data with internal and third-party verification APIs.

-

Any mismatch triggers automatic review or escalation.

Result: Banks report up to 65% faster KYC cycle times and 99.3% accuracy in document validation.

2. Contextual Risk Scoring in Real Time

Agentic AI doesn’t just validate documents — it understands the behavioral and transactional context behind each customer profile.

For example:

-

An address change within 24 hours of a large transfer = elevated risk

-

New device login + high-value transaction = trigger verification

By combining transactional, behavioral, and sentiment data, Agentic AI produces dynamic risk scores — enabling compliance teams to prioritize suspicious cases faster.

3. Automated Regulatory Documentation

For compliance officers, maintaining a transparent audit trail is often tedious.

Agentic AI automatically generates and stores documentation for every verification step — ensuring AI for compliance that’s traceable and audit-ready.

This eliminates human error in data entry and simplifies regulatory reviews.

How Agentic AI Strengthens Fraud Detection (Next-Gen AI Fraud Detection)

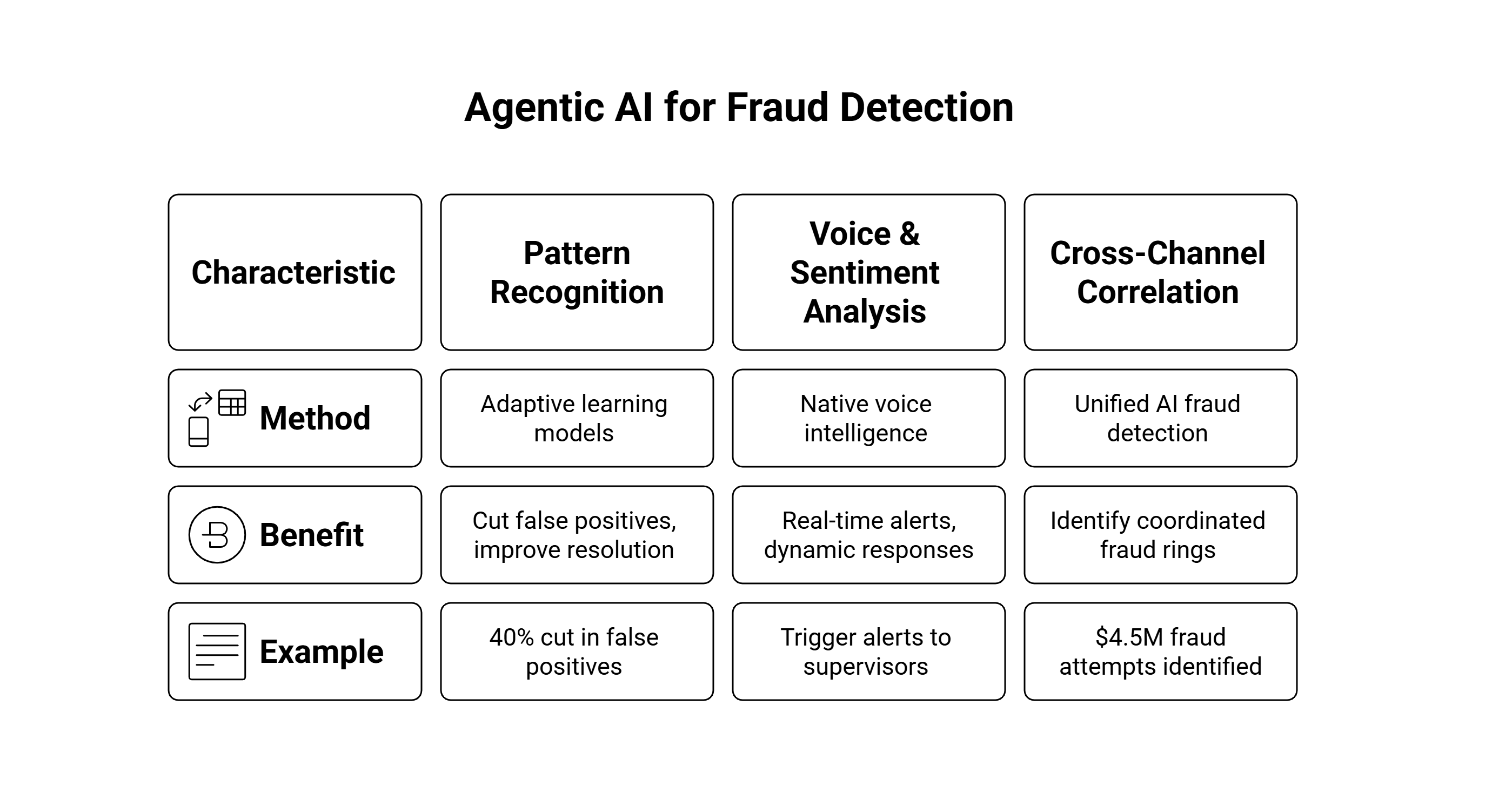

1. Pattern Recognition Beyond Human Speed

Modern fraud is multi-layered — spanning cards, digital payments, loans, and identity theft.

Rule-based systems struggle to adapt, but Agentic AI uses adaptive learning models that:

-

Analyze billions of data points across interactions

-

Spot anomalies invisible to human reviewers

-

Continuously evolve detection accuracy

Capgemini reports that AI-driven fraud detection can cut false positives by 40% and improve case resolution by 25%.

2. Voice & Sentiment Analysis in Live Interactions

Using Amazon Connect’s native voice intelligence, Agentic AI listens for:

-

Emotional stress cues

-

Speech hesitations during verification

-

Unusual caller behavior (like repeated phrases)

If an anomaly is detected, it can:

-

Trigger real-time alerts to supervisors

-

Initiate dynamic challenge-response questions

-

Auto-create fraud cases in the CRM

This real-time detection reduces potential financial loss and boosts security confidence.

3. Cross-Channel Fraud Correlation

Fraud doesn’t happen in isolation. Agentic AI correlates patterns across:

-

Voice calls

-

Emails

-

Chat transcripts

-

Transaction logs

This unified AI fraud detection framework helps identify coordinated fraud rings and suspicious activity across geographies.

Case in Point:

A multinational bank using Amazon Connect + Data Sleek’s AI integration identified $4.5M in fraud attempts within just one quarter — thanks to multi-channel correlation models.

Compliance & Governance — Built Into the Core

With global regulations like GDPR, CCPA, and FATF AML directives, compliance isn’t optional — it’s essential.

Agentic AI automates the heavy lifting by:

-

Logging every action, query, and verification

-

Creating immutable audit trails

-

Monitoring compliance KPIs in real time

-

Generating auto-filled compliance reports

This makes staying compliant faster, easier, and more reliable — without expanding manual review teams.

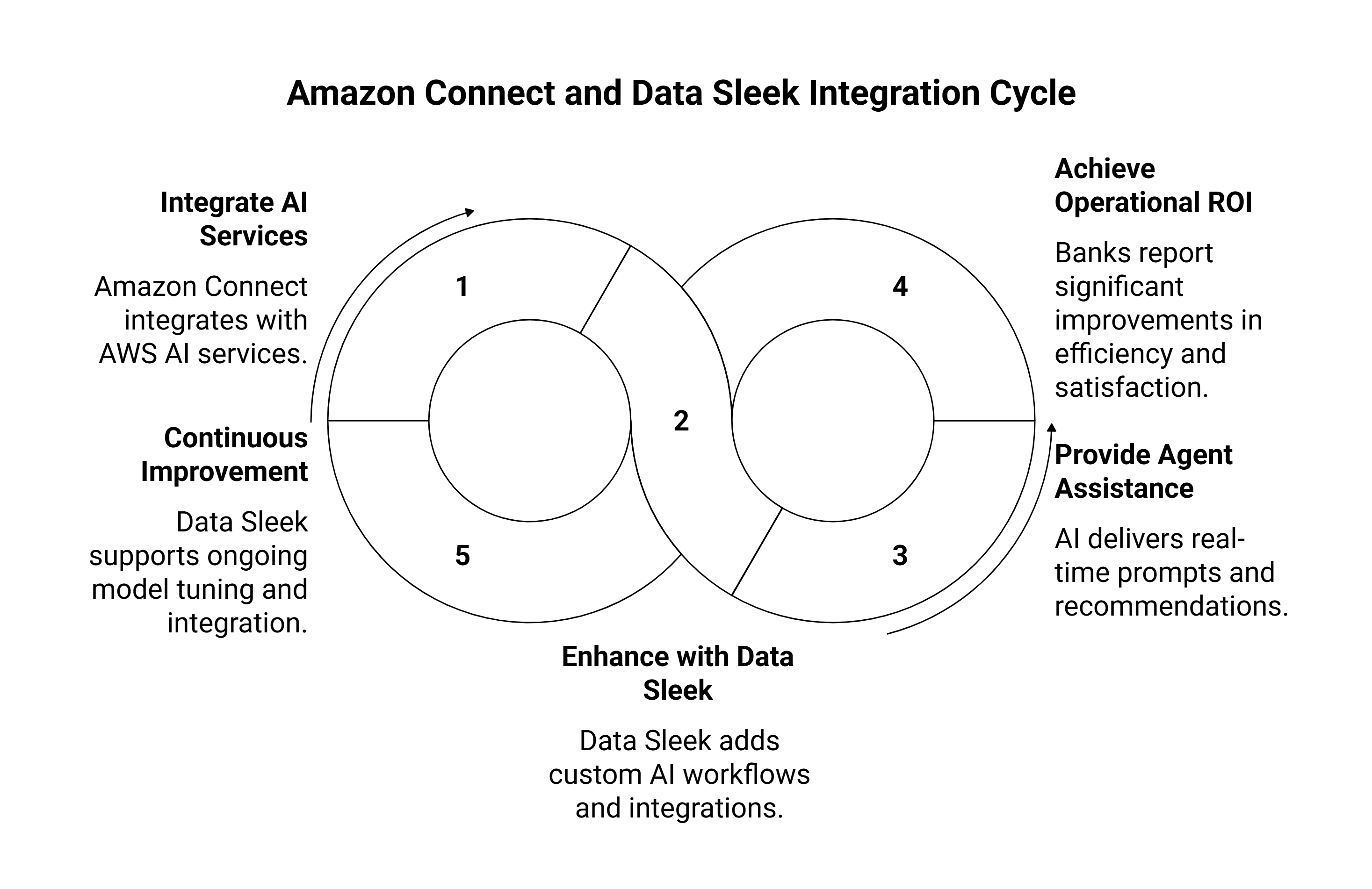

How Amazon Connect + Data Sleek Bring It All Together

1. Unified AI-Powered Contact Center

Amazon Connect’s open architecture integrates seamlessly with AWS AI services like:

-

Amazon Bedrock – for reasoning and decision-making

-

Amazon Q – for contextual knowledge retrieval

-

Amazon Comprehend & Transcribe – for NLP and voice analysis

Data Sleek enhances these with:

-

Custom Agentic AI workflows for KYC and fraud

-

CRM + core banking integrations

-

Real-time dashboards for compliance, fraud, and CX analytics

2. Proactive Agent Assistance

Inside the contact center workspace, Agentic AI delivers real-time prompts and recommendations:

-

Verify document? → Link provided instantly

-

Suspicious activity? → Suggest escalation

-

Repeat caller? → Display previous interaction history

This reduces agent cognitive load and accelerates contact center automation, leading to faster, more informed responses.

3. Operational ROI at Scale

Banks leveraging Agentic AI with Amazon Connect report:

-

30–50% reduction in average handling time (AHT)

-

40% drop in manual compliance errors

-

20% boost in customer satisfaction (CSAT)

-

Major cost savings from optimized agent utilization

When implemented by Data Sleek, these outcomes are supported by continuous model tuning, monitoring, and seamless integration.

The Future of Agentic AI in Banking

We’re entering a new phase where contact centers are not just service hubs but intelligence engines.

With Agentic AI, banks can evolve from:

-

Reactive fraud detection → Proactive prevention

-

Manual KYC → Self-learning compliance automation

-

Basic chatbots → Autonomous agents that act with intent

This is the foundation of intelligent, human-centered banking — where AI and empathy coexist to deliver trust, speed, and transparency.

Conclusion: Intelligent Banking Starts with Agentic AI

By combining Amazon Connect’s intelligent contact center framework with Data Sleek’s Agentic AI expertise, financial institutions can achieve:

-

Instant and accurate KYC verification

-

Real-time fraud prevention powered by contextual intelligence

-

Continuous, transparent compliance visibility

But beyond speed and automation, Agentic AI brings something deeper — it restores human trust in digital banking.

Agentic AI doesn’t just make banking faster — it makes it more human, secure, and trustworthy.

It empowers agents to act with confidence, customers to feel understood, and banks to operate with integrity in every interaction.

The future of banking isn’t just intelligent — it’s empathetic, adaptive, and built on Agentic AI.