Let’s Face It — Disputes Are a Costly Drag on Financial Operations

Every minute spent resolving a dispute impacts both the bottom line and customer trust.

In banking and finance, disputes over payments, failed transfers, unauthorized transactions, or chargebacks aren’t rare — they’re routine.

The problem?

Legacy systems and manual workflows mean resolution often takes 7–15 days, costing institutions time, labor, and customer goodwill.

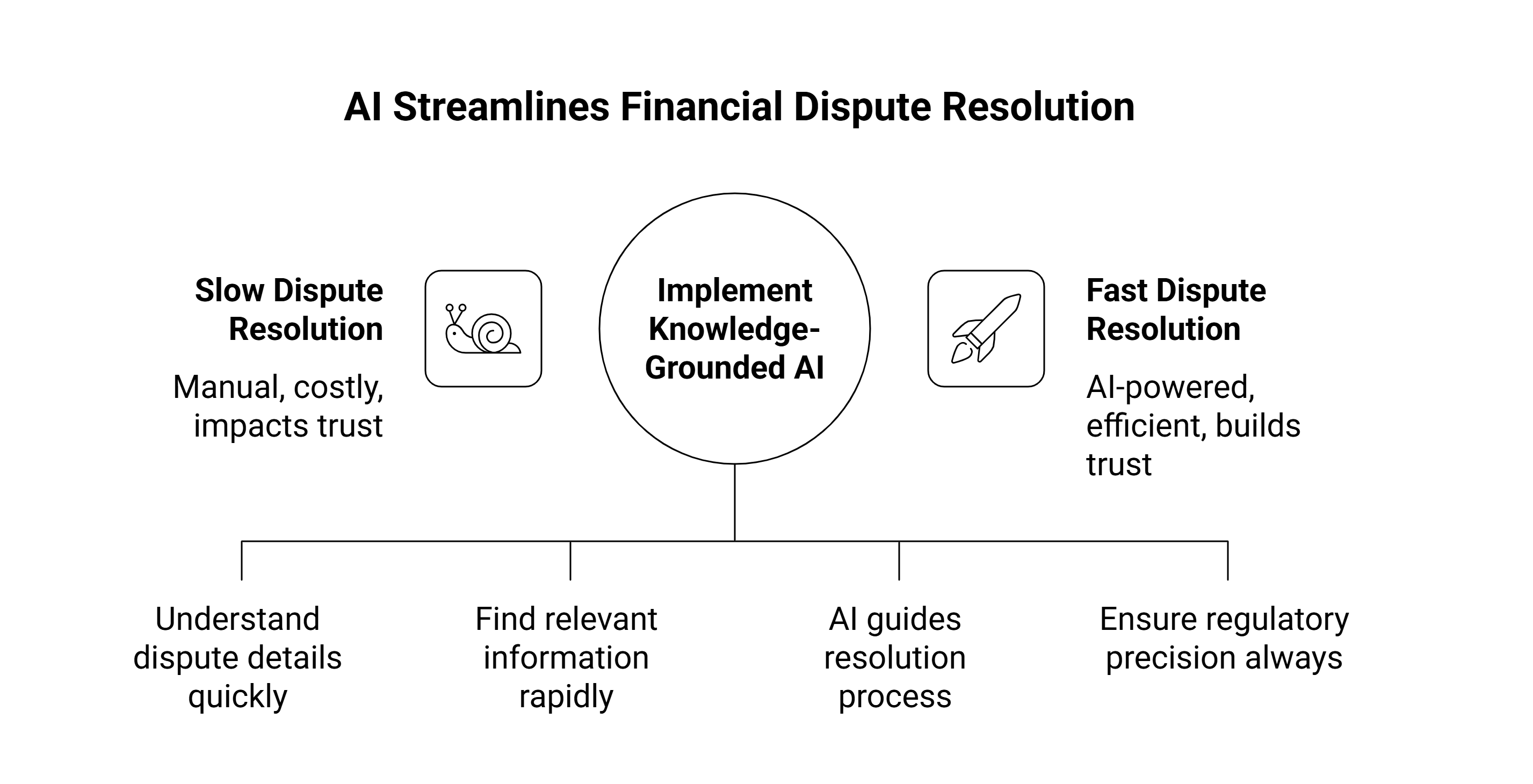

Now, the shift is happening fast: Knowledge-Grounded AI (KGAI) is enabling banks to cut resolution times by up to 40%, while maintaining regulatory precision and compliance integrity.

Let’s break down how.

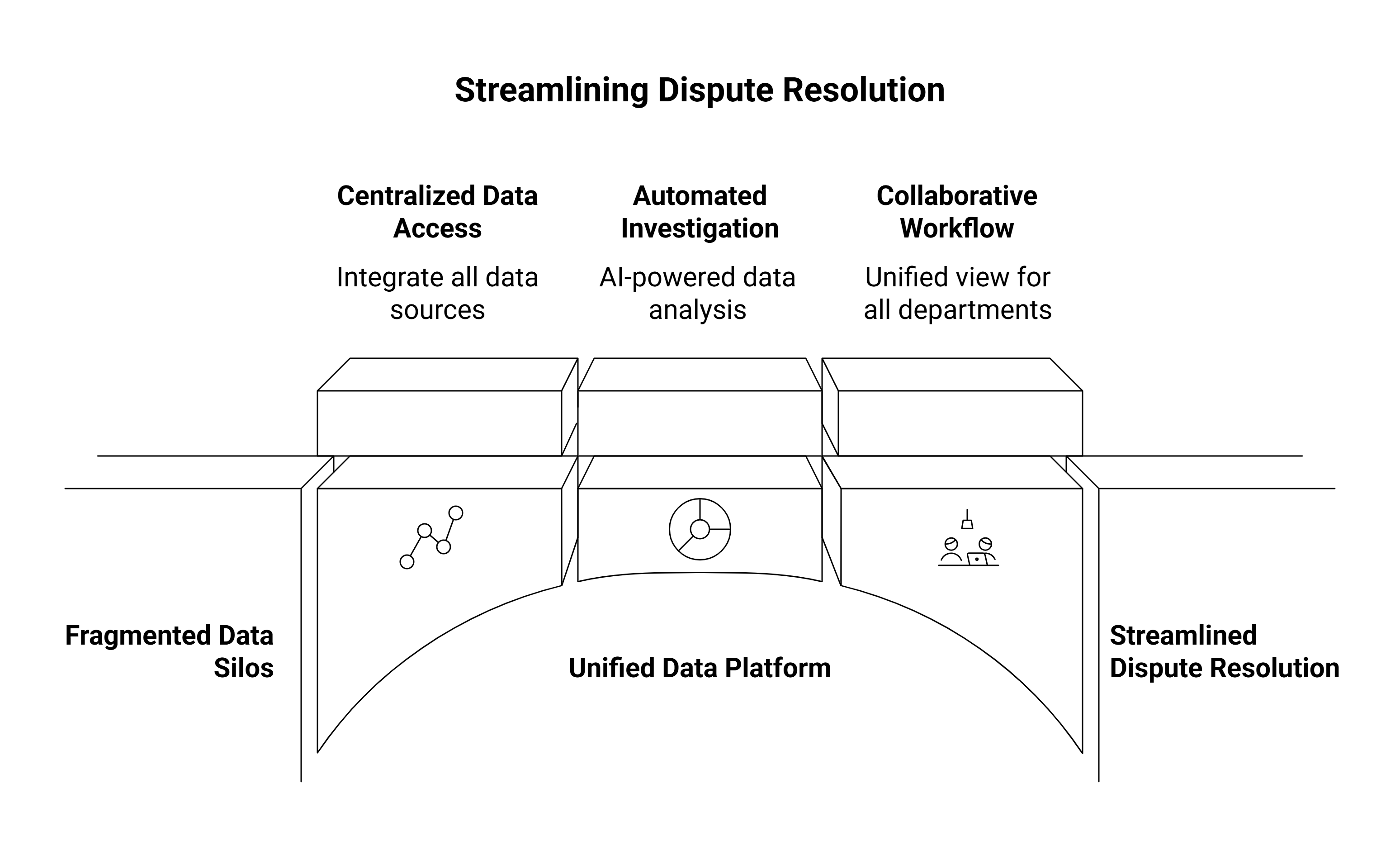

The Old Way: Fragmented Data, Slow Responses

Here’s what traditional dispute handling looks like in most financial contact centers:

- Multiple disconnected systems: CRM, transaction logs, compliance databases, and chat records all live in silos.

- Manual investigation: Agents must sift through hundreds of data points — transaction histories, policy docs, dispute codes, and customer correspondence.

- No unified view: Each department (operations, compliance, risk) works separately, delaying resolution.

Result?

Slow turnaround, inconsistent decisions, and frustrated customers.

According to McKinsey’s 2024 study, financial institutions spend up to 25% of contact center time just verifying information before resolving a case.

The New Way: Knowledge-Grounded AI Speeds Up Every Step

Grounded in Facts, Not Guesswork

Unlike generic AI models, Knowledge-Grounded AI (KGAI) connects directly to your organization’s verified sources — transactional data, compliance policies, FAQs, case histories, and regulatory documents.

That means every AI response or recommendation is backed by traceable knowledge, not surface-level summaries.

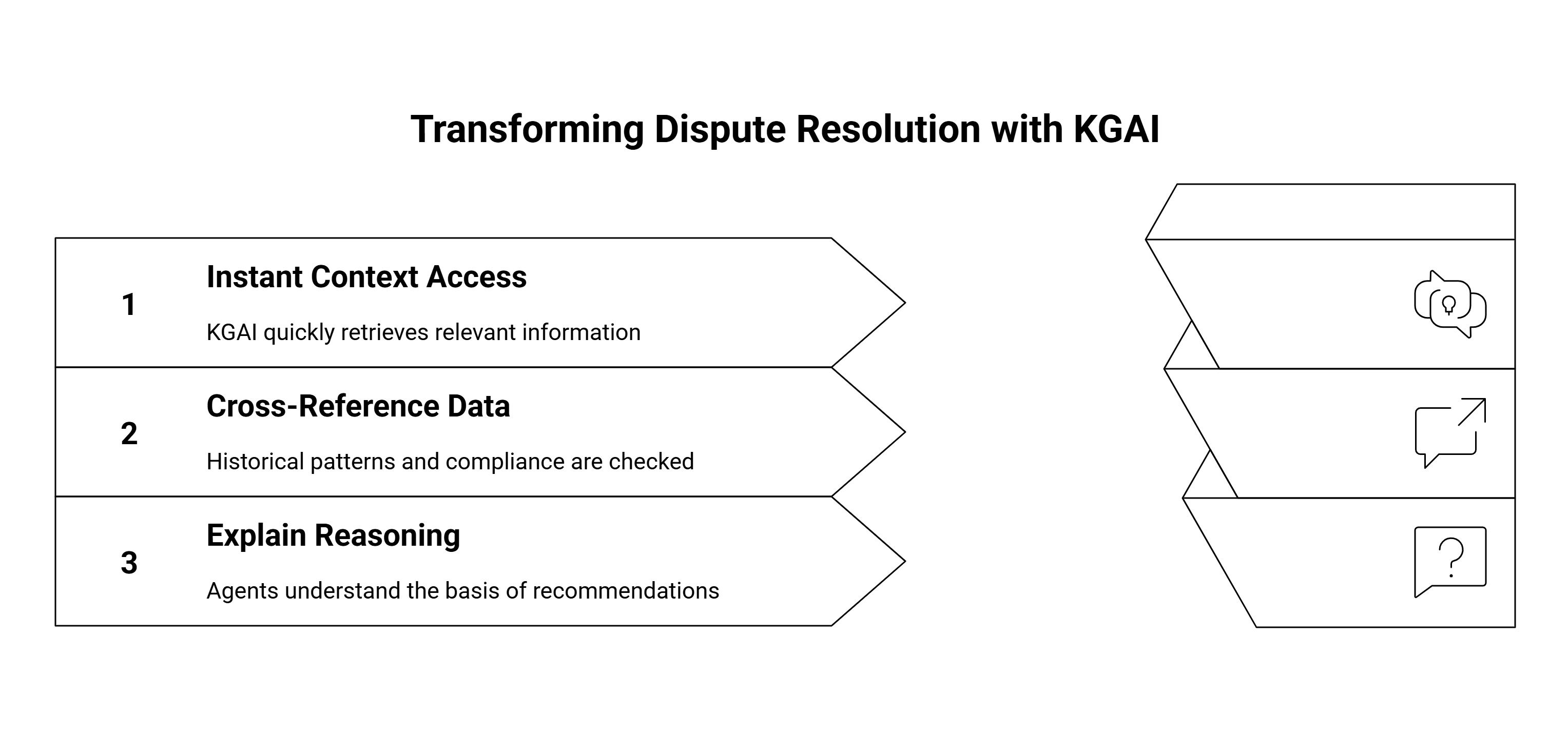

Here’s how it transforms dispute resolution:

- Instant access to context: KGAI surfaces the right policy, transaction, or precedent instantly.

- Cross-references data: It checks historical resolution patterns and compliance requirements before suggesting actions.

- Explains its reasoning: Agents can see why a recommendation was made — crucial for audit trails and compliance.

The Result:

Banks using knowledge-grounded AI report:

- 35–40% reduction in average dispute resolution time

- 60% lower manual lookup effort

- 25% fewer compliance escalations

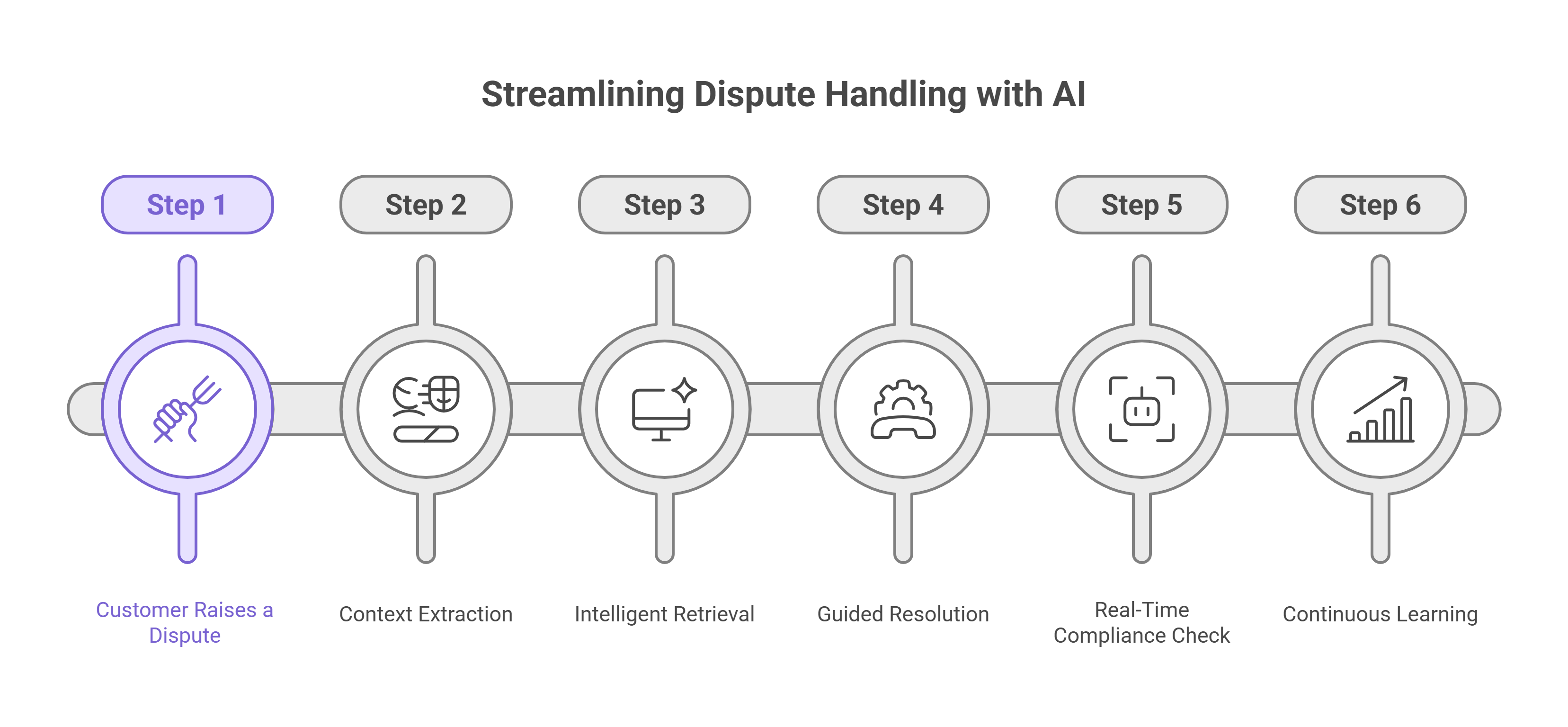

Step-by-Step: How Knowledge-Grounded AI Works in Dispute Handling

Let’s walk through a real-world flow:

Step 1 – Customer Raises a Dispute

A customer calls or chats about an incorrect transaction.

Amazon Connect routes this query to an agent supported by Data Sleek’s Knowledge-Grounded AI integration.

Step 2 – Context Extraction

The AI automatically extracts relevant details — transaction ID, date, merchant name, dispute type — from the CRM and call transcript.

Step 3 – Intelligent Retrieval

KGAI searches across connected data sources (transaction systems, internal policies, legal guidelines) to retrieve matching cases and possible resolutions.

Step 4 – Guided Resolution

It presents the agent with:

- Possible outcomes based on precedent

- Required documents or customer confirmations

- Estimated resolution time and compliance notes

Step 5 – Real-Time Compliance Check

Before the resolution is submitted, the AI validates that all steps meet regulatory and internal standards, reducing error risk.

Step 6 – Continuous Learning

Each resolved case feeds back into the system, improving next-case accuracy and reducing the need for human intervention.

Why “Knowledge-Grounded” Matters More Than Ever

AI hallucination — generating confident but incorrect answers — is a major risk in regulated sectors like finance.

Knowledge-Grounded AI fixes that.

By tying every insight to a verified data source, it ensures reliability, transparency, and auditability.

That’s a game-changer for compliance-heavy workflows.

According to Forrester (2025), financial institutions that adopted knowledge-grounded AI reduced false or unverifiable outputs by 80%, compared to generic LLM deployments.

Data Sleek’s Approach: Bringing Knowledge and Action Together

At Data Sleek, we specialize in integrating Knowledge-Grounded AI within Amazon Connect environments — transforming contact centers into intelligent decision hubs.

Here’s how we do it:

| Capability | What It Delivers |

| Data Integration Pipelines | Connects CRM, transaction, and compliance data sources |

| Amazon Bedrock Integration | Provides reliable, explainable generative responses |

| Knowledge Graph Layer | Maps relationships between disputes, outcomes, and policies |

| Real-Time Agent Assistance | Surfaces validated insights directly in the Amazon Connect workspace |

| Continuous Feedback Loops | Retrains models based on resolved cases |

This creates a unified environment where AI doesn’t replace humans — it empowers them with verified intelligence.

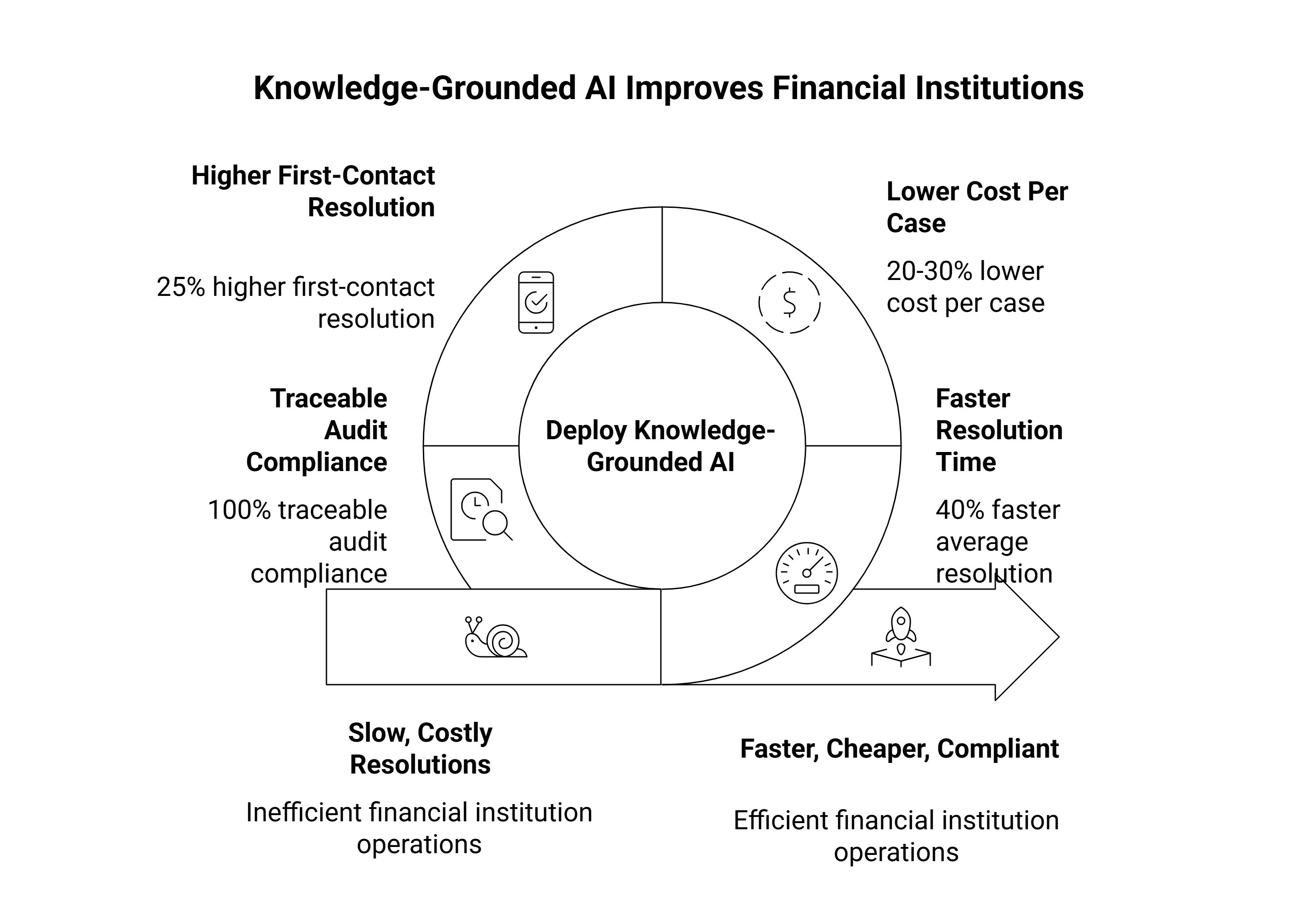

The Business Impact: Faster, Cheaper, More Compliant

When financial institutions deploy knowledge-grounded AI with Data Sleek, the numbers speak for themselves:

- 40% faster average resolution time

- 20–30% lower cost per case

- Higher first-contact resolution (FCR) by 25%

- 100% traceable audit compliance

Beyond the metrics, the customer sentiment shift is massive — because faster, accurate resolutions rebuild trust faster than any marketing campaign ever could.

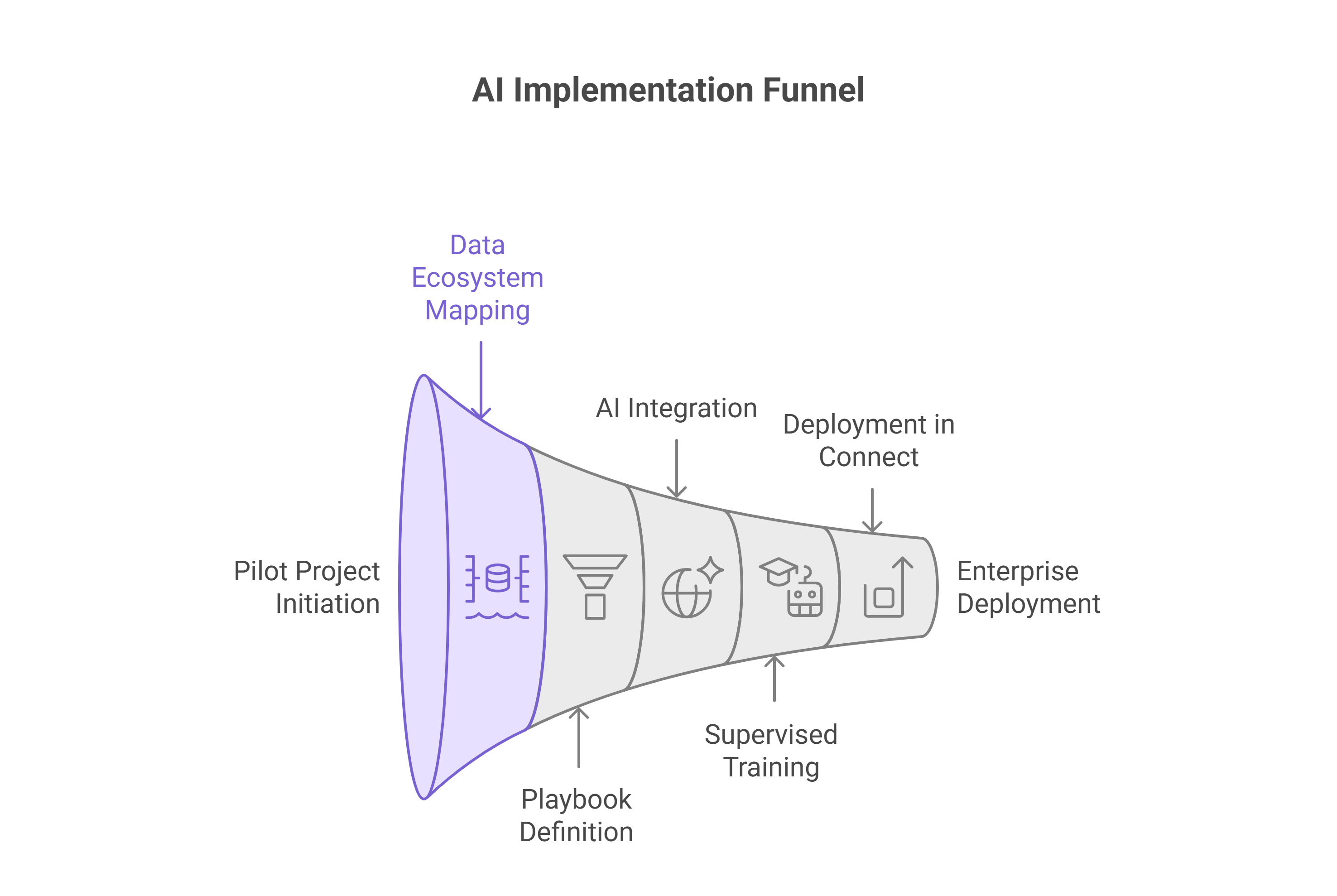

Implementation Blueprint: From Pilot to Full Rollout

- Map your data ecosystem: Identify verified knowledge sources.

- Define resolution playbooks: Document workflows for each dispute type.

- Integrate AI layer: Use Bedrock to ground AI in real data.

- Train with supervision: Validate AI recommendations against real case outcomes.

- Deploy in Amazon Connect: Start in assist mode, then automate simple cases.

- Track and refine: Measure resolution time, accuracy, and compliance continuously.

Within 60–90 days, you can move from pilot to enterprise deployment.

Beyond Resolution: The Future of AI in Financial Operations

Knowledge-Grounded AI won’t just stop at disputes.

It’s already reshaping:

- KYC verification through document understanding

- Fraud detection with predictive intelligence

- Customer support with personalized financial insights

The future financial contact center isn’t just responsive — it’s cognitively aware.

And with Agentic AI, the next step is self-evolving workflows that learn, decide, and act — all while staying within compliance boundaries.

Final Takeaway: From Data to Trust, at Scale

Disputes are unavoidable.

Delays aren’t.

By grounding AI in verified financial knowledge, banks and fintech companies can ensure accuracy, speed, and compliance in every interaction.

That’s what Data Sleek’s Knowledge-Grounded AI brings to Amazon Connect —

Not just automation, but trust that scales.